Investors intending to take out insurance on Saudi Arabian bonds would have to pay as much as they do with troubled Portugal. The price of insuring Riyadh’s debt has more than doubled in the past 12 months as oil prices continue to collapse, Bloomberg reports.

With crude prices at 12-year lows, the Kingdom continues to bankroll a war in Yemen. Last year, Saudi Arabia sold bonds for the first time since 2007 to cover the budget deficit.

The country’s net foreign assets dropped to $627 billion in 10 consecutive months through November. This was the longest losing streak since 2006.

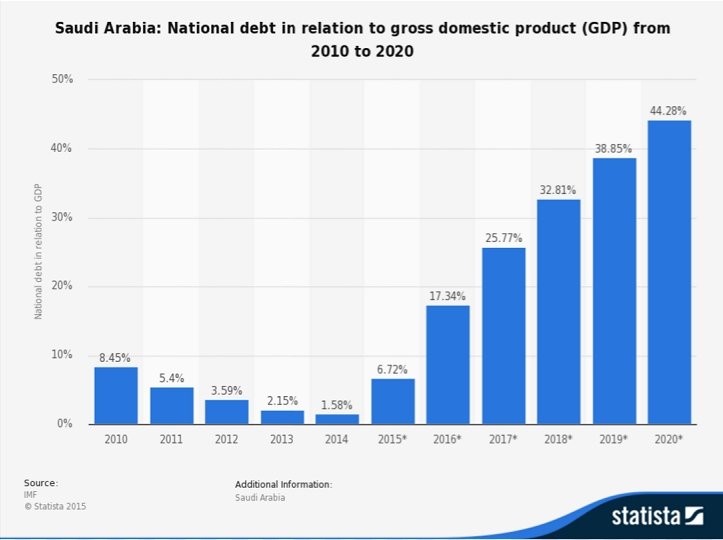

“They have huge reserves and extremely low debt, but the question is, how long are oil prices going to stay at this level?” Anthony Simond, an investment manager at London-based Aberdeen Asset Management told Bloomberg.

On Tuesday, Brent benchmark fell below $31 per barrel for the first time since 2004, trading as low as $30.50. The prices rebounded in intraday trading to almost $32; however, some analysts say there is no bottom in sight for the oil market. On Tuesday, Standard Chartered said that crude was heading for $10 per barrel.

At the end of last year, Saudi Arabia reported record high $98 billion budget deficit and estimated this year’s deficit at $87 billion on low crude prices.

READ MORE: Saudi Arabia could be bankrupt by 2020 – IMF

The country’s earnings in 2016 are forecast at $137 billion, $25 billion down from 2015. Last year’s original budget projected almost $191 billion.

___________

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy

Comments are closed.