Economists are still hotly debating whether the oil crash has been a net positive for advanced economies.

Optimists argue that cheap oil is a good thing for consumers and commodity-sensitive businesses, while pessimists point to the hit to energy-related investment and possible spillover into the financial system.

A new note from Francisco Blanch at Bank of America Merrill Lynch, however, puts the oil move into a much bigger perspective, arguing that a sustained price plunge “will push back $3 trillion a year from oil producers to global consumers, setting the stage for one of the largest transfers of wealth in human history.”

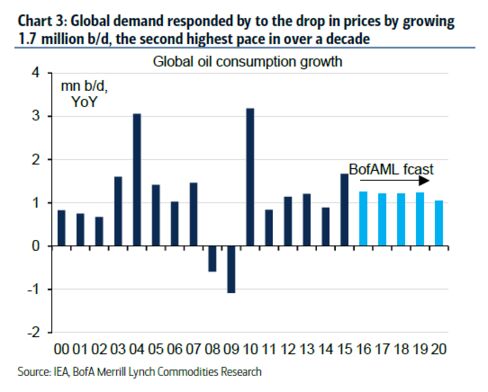

Blanch and his team already see evidence that the fall in the price of crude is having a positive impact on demand, and say that it could accelerate even further if prices don’t pick up.

Read more at Bloomberg

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy

Comments are closed.